The Victorian Government’s R&D Cash Flow Loans initiative is now open for enquiries. The initiative, which was announces as part of the 2020/21 budget in October, aims to support SMEs in Victoria by investing in research and development activity to develop products, services and technologies vital to the State’s future economy. Loans of up to 80% of the expected value of a company’s refundable R&D Tax Offset are on offer.

Loan Terms

Low-interest loans provided by Treasury Corporation of Victoria (TCV) are available to eligible businesses. Total funding for the initiative is capped at A$50 million with the following indicative loan terms:

- Minimum loan amount: $250,000

- Maximum loan amount: $4 million

- Facility term: 12 to 28 months

- Security required: R&D Tax Offset and Related Assets.

Eligibility

Eligible entities should meet the following criteria to be eligible to receive a loan under R&D Cash Flow Loans.

The business:

- is seeking a loan valued between $250,000 and $4 million;

- is prepared to enter into a standardised TCV Loan Agreement with non-negotiable terms and conditions in the TCV Loan Agreement;

- has previously received the Commonwealth Government’s R&D Tax Incentive refund, and will be eligible to be a recipient for future refunds based on forecast R&D activities;

- does not engage in prohibited activities (click here for a list of prohibited activities).

It is important to note that meeting the eligibility criteria alone does not ensure that the entity will receive loans under the initiative.

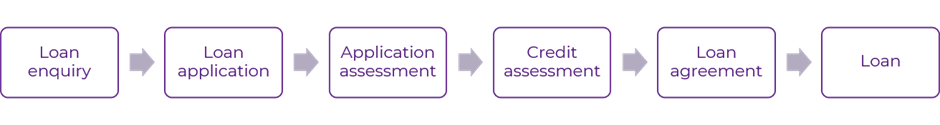

Application Process

Application for the R&D Cash Flow Loans follows a six-step process. Businesses are first required to register their interest by submitting a loan enquiry.

Learn More About The R&D Cash Flow Loans

To learn more about this financing solution, please click here to access the FAQ page of the R&D Cash Flow Loans.

Please note: The Victorian Government’s R&D Cash Flow Loans initiative and the Commonwealth Government’s R&D Tax Incentive are two separate unrelated programs.

If you would like to learn more about the R&D Cash Flow Loans, please contact Saving Point now and one of our expert consultants will be in touch with you.