The new 2015-16 financial year is only six weeks away, and with the release of Federal and Victorian State Budgets, there are a few points to note and opportunities to explore.

Let’s first dive into the two popular stayers in the Government toolbox that require immediate attention and then go over proposed new opportunities.

1. R&D Tax Incentive

The Australian government provided up to $2 billion per annum in additional funding to eligible businesses via the R&D Tax Incentive during the 2013-14 income period, which is an increase of over 850 registrations compared to 2012-13.

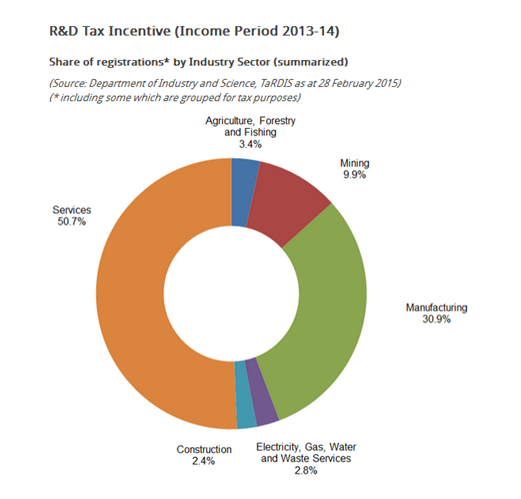

Of the over 7,300 companies to complete registration for the R&D Tax Incentive for the 2013-14 income period:

- 25% are based in Victoria

- 50.7% are in the professional services industry, which includes software development and engineering projects

- 30.9% are in the manufacturing industry

- 9.9% are in the mining industry.

Here is a quick reminder in relation to the upcoming R&D Tax Incentive deadline and other actionable items.

Actionable Items Prior to June 30, 2015:

- Payments to associates: Payments to associates have to be made if wish to claim these expenses as part of the 2014-15 application.

- Findings: Submit Overseas Finding application for eligible R&D activities undertaken overseas this financial year.

- Record Keeping: Record all potential R&D activities and ensure that contemporaneous documents are retained to substantiate the claim.

AusIndustry has released a number of guidance papers in relation to different industries such as Energy, Construction, IT and Manufacturing. It is worth reviewing these guides as they can assist with maximising claims and meeting compliance obligations.

Please feel free to contact us should you wish to obtain copy.

2. EMDG Claims

Applications for grant year 2013-14 up by 18%

The number of EMDG applications received in 2014-15 increased by 18%, with 3,195 grant applicants compared to 2,715 applicants in 2013-14.

Austrade considers this to be mainly due to the changes made to the scheme by the Government in 2014 to enhance access to the scheme following the allocation of an additional $50 million over four years commencing in 2013-14. This increase may also be due in part to the lower Australian dollar in 2013-14.

At the same time, total claim values, subject to assessment, have increased from $136m in grant year 2012-13 to $165m this year for grant year 2013-14.

Previously, in 2013-14, grant applications for grant year 2012-13 had declined by 11%.

EMDG grant application dates for grant year 2014-15

Please note that applications for the 2014-15 grant year will open on 1 July 2015, and close on 30 November 2015, or on 29 February 2016 for those who use an approved EMDG Consultant to lodge their claim.

Accurate and complete applications lodged before end September 2015 will normally be processed more quickly than those lodged in October and November, or later, facilitating early cash flow to those applicants of up to the amount of the initial payment ceiling.

Actionable Items Prior to June 30, 2015:

- EMDG: Physical payments have to be made for eligible expenses to claim for 2014-15.

- EMDG: Record Keeping and Documentation

3. Federal Government Programs

Growing Jobs and Small Business

One of the main focuses of the 2015 Federal Budget is supporting small businesses and stimulating job growth throughout Australia. Proposals outlined in the budget included:

- Small businesses are being encouraged to invest and expand their operations via an immediate deduction on each asset under $20,000. This deduction period commenced as of 12 May 2015 and will continue to 30 June 2017.

- Small businesses that have an annual turnover of less than $2 million will have their tax rate cut by 1.5%. For incorporated businesses, this will be 5% tax discount.

- The government will reduce red tape in the fringe benefits tax system, ensuring all small business work-related portable electronic devices are FBT free.

- There will be a reduction in setup costs for start-ups and small businesses via immediate tax deductions.

Entrepreneur’s Infrastructure Program

The Entrepreneur’s Infrastructure Program, introduced in the 2014-15 Budget, is aimed at investing in growth and productivity for globally competitive industries.

The current budget revealed that $526.4 million in funding has been provided to support industry objectives for a four year period from 2015-16 onwards. Other government programs can be complemented with this service, such as the R&D Tax Incentive, Industry Skills Fund, Industry Growth Funds and the Manufacturing Transition Fund.

4. Victorian State Government Programs

The Victorian government has recently announced plans to establish several new funds and grant programs in the 2015 Labor budget.

The funds are aimed at stimulating job growth in both regional and metropolitan Victoria and establishing a higher skilled workforce. This comes after a 1.9% increase in unemployment between 2010-15.

Included in Labor’s proposal is the $200 million Future Industries Fund, which is to be invested in job-creating projects in high-growth areas, and the $200 million Regional Jobs Fund, which is to be invested in job-creating projects in rural Victoria.

The Future Industries Fund grants will be aimed at key industries such as:

- Medical technology and pharmaceuticals

- New energy technology

- Food and fibre processing

- Transport, defence and construction technology

- International education

- Professional services

While eligibility criteria and the exact structure of the Future Industries Fund is yet to be announced, it is likely that there will be two streams of financial assistance:

- Enterprise – up to $500,000 for a project involving one company

- Supply Chain – up to $1 million for a collaborative project involving multiple companies

The Regional Jobs Fund will aim to support the following activities:

- Manufacturing and processing plants upgrading their facilities

- Incentives for large companies to move to, or expand into, regional Victoria

- Marketing support for regional businesses who are exporting internationally

- Companies investing in renewable energy

Also included in the budget is the $508 million Jobs and Investment Fund, which features a $60 million start-up initiative to assist entrepreneurs and emerging companies in establishing themselves.